Best Business Podcast (Gold), British Podcast Awards 2023 How do you build a fully electric motorcycle with no compromises on performance? How can we truly experience what the virtual world feels like? What does it take to design the first commercially available flying car? And how do you build a lightsaber? These are some of the questions this podcast answers as we share the moments where digital transforms physical, and meet the brilliant minds behind some of the most innovative products a ...

…

continue reading

Content provided by Not Your Average Financial Podcast™. All podcast content including episodes, graphics, and podcast descriptions are uploaded and provided directly by Not Your Average Financial Podcast™ or their podcast platform partner. If you believe someone is using your copyrighted work without your permission, you can follow the process outlined here https://ro.player.fm/legal.

Player FM - Aplicație Podcast

Treceți offline cu aplicația Player FM !

Treceți offline cu aplicația Player FM !

Episode 346: When Bank on Yourself® Policy Loans Matter Most

Manage episode 413322866 series 1610796

Content provided by Not Your Average Financial Podcast™. All podcast content including episodes, graphics, and podcast descriptions are uploaded and provided directly by Not Your Average Financial Podcast™ or their podcast platform partner. If you believe someone is using your copyrighted work without your permission, you can follow the process outlined here https://ro.player.fm/legal.

In this episode, we ask:

- Why haven’t you subscribed yet?

- What big purchases are coming up?

- Can you earn your way out of expenses?

- What happens in retirement?

- Can you earn your way out of expenses throughout all of the ages of life?

- What’s the difference between earning income at age 35 and age 86?

- What allows for uninterrupted compounding?

- How is this possible?

- Who offers non-direct recognition policy loans?

- How about an example?

- What is the amount of the cash value?

- What is the simple interest rate on the policy loan?

- What happens over four years?

- What happens to the policy?

- What is the gain?

- Did you earn more than you spent?

- What happens over a longer time horizon?

- What about dividends?

- Would you like to hear Episode 345?

- Would you like us to review your policy?

- What is unbelievably cool?

- What products stop growing your money when you spend it?

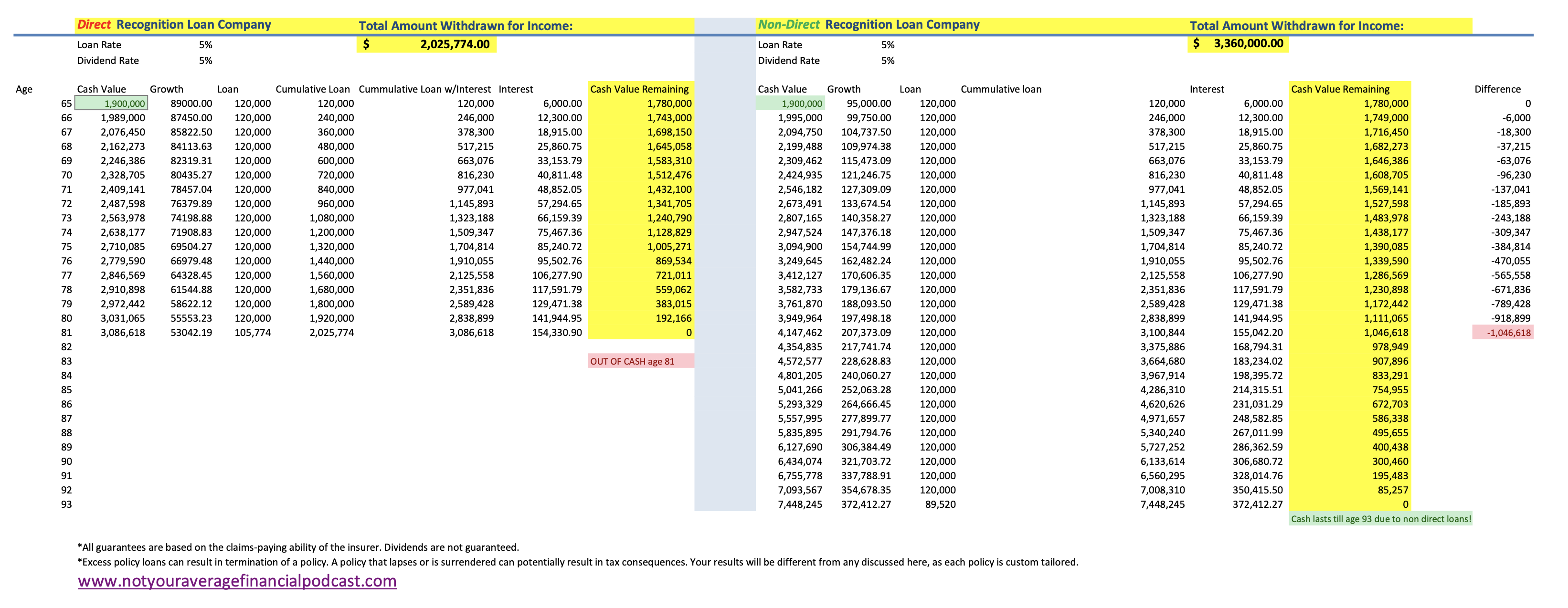

- Can you imagine this chart?

- What happens on the spend down?

- What continues to earn interest?

- What if you could continue to maintain the compounding growth on your money?

- What are the implications?

- What results shocked Mark?

- What if they never paid off the loan?

- How about another apples-to-apples example?

- What does a policy loan look like in a direct recognition policy?

- What about the interest?

- What about receiving a weird letter from the insurer at age 81?

- Where was the compounding?

- Where did the growth go?

- What does a policy loan look like in a non-direct recognition policy?

- What about the interest?

- What is the difference?

- What is the policy growth based upon?

- What about compounding and accumulation?

- What about loan interest?

- How much more?

- Is the policy designed the right way?

- Who is getting penalized?

- How about a timely warning?

- Does your agent understand the working parts well?

- Is your policy built correctly?

- Is your policy breaking compound growth?

- What about the Gold Standard of the Bank on Yourself® Professional training?

- What would it look like?

- What about absolute certainty?

- Do you have to know everything about how your phone was engineered to enjoy it?

- How is a Bank on Yourself® type whole life insurance policy like a smart phone?

- When was the last time you reviewed your current policy?

- Would you like a second set of eyes?

- Would you like to learn more by listening through our Episodes in a List?

- What about time?

- Are you serious?

- Would you like a meeting with me or an associate?

335 episoade

Manage episode 413322866 series 1610796

Content provided by Not Your Average Financial Podcast™. All podcast content including episodes, graphics, and podcast descriptions are uploaded and provided directly by Not Your Average Financial Podcast™ or their podcast platform partner. If you believe someone is using your copyrighted work without your permission, you can follow the process outlined here https://ro.player.fm/legal.

In this episode, we ask:

- Why haven’t you subscribed yet?

- What big purchases are coming up?

- Can you earn your way out of expenses?

- What happens in retirement?

- Can you earn your way out of expenses throughout all of the ages of life?

- What’s the difference between earning income at age 35 and age 86?

- What allows for uninterrupted compounding?

- How is this possible?

- Who offers non-direct recognition policy loans?

- How about an example?

- What is the amount of the cash value?

- What is the simple interest rate on the policy loan?

- What happens over four years?

- What happens to the policy?

- What is the gain?

- Did you earn more than you spent?

- What happens over a longer time horizon?

- What about dividends?

- Would you like to hear Episode 345?

- Would you like us to review your policy?

- What is unbelievably cool?

- What products stop growing your money when you spend it?

- Can you imagine this chart?

- What happens on the spend down?

- What continues to earn interest?

- What if you could continue to maintain the compounding growth on your money?

- What are the implications?

- What results shocked Mark?

- What if they never paid off the loan?

- How about another apples-to-apples example?

- What does a policy loan look like in a direct recognition policy?

- What about the interest?

- What about receiving a weird letter from the insurer at age 81?

- Where was the compounding?

- Where did the growth go?

- What does a policy loan look like in a non-direct recognition policy?

- What about the interest?

- What is the difference?

- What is the policy growth based upon?

- What about compounding and accumulation?

- What about loan interest?

- How much more?

- Is the policy designed the right way?

- Who is getting penalized?

- How about a timely warning?

- Does your agent understand the working parts well?

- Is your policy built correctly?

- Is your policy breaking compound growth?

- What about the Gold Standard of the Bank on Yourself® Professional training?

- What would it look like?

- What about absolute certainty?

- Do you have to know everything about how your phone was engineered to enjoy it?

- How is a Bank on Yourself® type whole life insurance policy like a smart phone?

- When was the last time you reviewed your current policy?

- Would you like a second set of eyes?

- Would you like to learn more by listening through our Episodes in a List?

- What about time?

- Are you serious?

- Would you like a meeting with me or an associate?

335 episoade

Tous les épisodes

×Bun venit la Player FM!

Player FM scanează web-ul pentru podcast-uri de înaltă calitate pentru a vă putea bucura acum. Este cea mai bună aplicație pentru podcast și funcționează pe Android, iPhone și pe web. Înscrieți-vă pentru a sincroniza abonamentele pe toate dispozitivele.